Unlocking Financial Freedom: Why South Africans Should Take Advantage of Tax-Free Savings Accounts

Many South Africans are still unaware of one of the most powerful financial tools available to them, the Tax-Free Savings Account (TFSA). Introduced by the South African government in 2015, this savings vehicle was designed to encourage a culture of saving and investing by allowing individuals to earn tax-free returns on their money.

Yet, despite being nearly a decade old, millions of people still don’t fully understand how a TFSA works or how to make the most of it.

“Most people still don’t know about the tax-free savings account, and those who do often don’t use it to its full potential,” said Antoinette Mthetwa, Consumer Financial Education Project Manager at Avo Vision. “It’s one of the few tools that allow ordinary South Africans to grow their money without worrying about taxes eating into their returns (within the defined regulatory limitations.)”

“What makes it even more exciting is that TFSAs are accessible to everyone, whether you’re just starting out in your career or looking to grow wealth over decades,” Mthetwa added. “It’s not about how much you put in at first; it’s about consistency and letting your money work for you over time.”

What Makes a Tax-Free Savings Account Special?

A TFSA isn’t just another account, it’s a supercharged savings tool. Unlike traditional savings or investment accounts, it allows your money to grow completely tax-free. That means no tax on interest, dividends, or capital gains, every rand you earn stays in your pocket.

Here’s the breakdown of what you need to know before opening a TFSA:

- Annual contribution limit: R36 000 (as of 2025)

- Lifetime limit: R500 000

- Withdrawals: You can withdraw money anytime, but withdrawn amounts cannot be reinvested if you’ve already hit your lifetime limit

- Eligibility: Must be a South African resident and over 18 years old; minors can have accounts opened by a parent or guardian

- Requirements: South African Identity document and a bank account for contributions

While the name suggests “savings,” a TFSA can do much more. You can invest in unit trusts, exchange-traded funds (ETFs), or retail savings bonds, making it a versatile tool for both short-term goals (like a car or home deposit) and long-term goals (like retirement).

According to Avo Vision CEO Henry Sebata, it’s not just about opening a TFSA, it’s about choosing the right place to grow your money.

“I encourage people to explore options beyond traditional banks,” said Sebata. “Too often, we settle for convenience rather than growth. A TFSA is not just a place to keep money safe, it’s a tool to shape your financial destiny.”

Sebata also emphasised, “It’s not just about saving; it’s about creating a future where your money works for you. The TFSA allows you to take control of your financial journey, to make deliberate choices that will impact your life decades from now.”

“This is why financial literacy matters,” he added. “Knowledge transforms decisions into opportunities. A TFSA is simple, yet its potential to compound your wealth over time is extraordinary. It’s not just a financial account, it’s a foundation for freedom, independence, and security.”

Tips to Make the Most of Your TFSA

1. Start early – Even small monthly contributions add up over time. Starting now can mean thousands more in your pocket later.

2. Be consistent – Set up an automatic debit order so you don’t skip months. Your future self will thank you.

3. Think long-term – Withdrawing reduces your lifetime limit. Treat it like an investment, not a rainy-day account.

4. Shop around – Compare providers to find the best interest or growth rate. Don’t settle for low returns.

Building a Culture of Saving

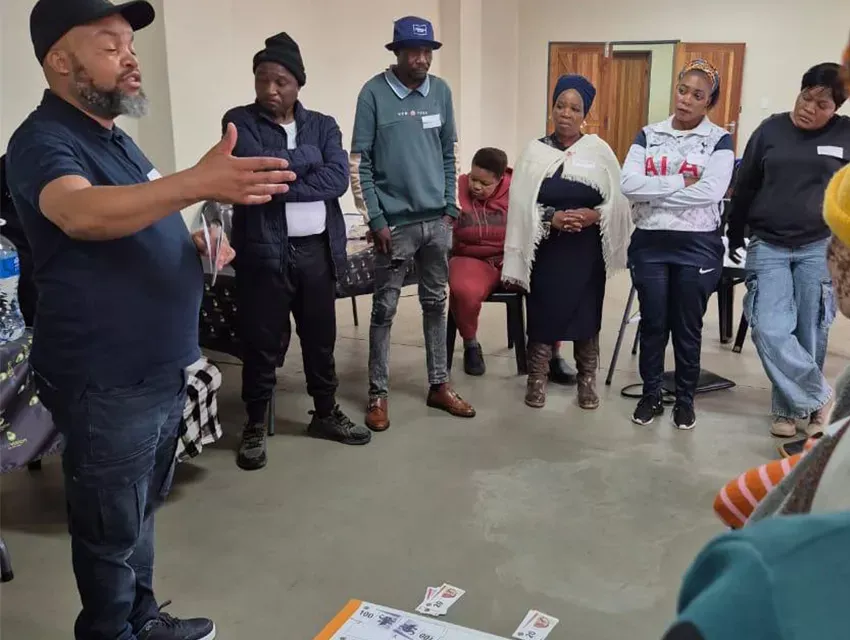

At Avo Vision, financial education is at the heart of empowering South Africans. The organisation’s Consumer Financial Education (CFE) Programme focuses on helping people understand tools like budgeting, and responsible credit use.

“Financial freedom starts with knowledge,” said Mthetwa. “A TFSA might seem small, but it’s a step toward building a stronger financial future, one decision at a time.”

A Tax-Free Savings Account is not just another product; it’s a gateway to financial independence. Whether you’re saving for your child’s education, a home deposit, or your retirement, the TFSA gives your money the freedom to grow, without tax holding it back.