In South Africa, financial literacy is a major barrier to economic stability, with many individuals struggling to manage finances and debt despite various educational initiatives. This research by Avo Vision research team aims to assess the state of financial literacy, explore its links to socioeconomic factors, evaluate existing initiatives, and propose strategies for improving financial management and long-term financial planning.

Introduction to Financial Literacy

In South Africa, the challenge of managing personal finances and handling debt has become a significant barrier to economic stability for many individuals. Despite numerous initiatives by the government, banks, and financial institutions aimed at promoting financial literacy, many South Africans continue to struggle with financial management. This persistent difficulty hampers their ability to build wealth and escape the cycle of poverty. A critical examination of this issue reveals that financial literacy plays a crucial role in overcoming these challenges.

As Qoako highlights, "Financial literacy empowers us to overcome poverty through knowledge and changed behaviour." However, recent findings from the FSCA and HSRC 2020 Financial Literacy Baseline Survey indicate that the average financial literacy score of South Africans, measured between 2012 and 2020, stands at a modest 52 out of 100 (Zerbst, 2024). This score reflects a substantial gap in financial knowledge and underscores the need for enhanced educational efforts. Scheepers aptly points out, “Understanding how a budget works, and knowing the principles of saving for a rainy day, should be as common as knowing how to brush your teeth.” This comparison underscores the importance of making financial literacy an integral part of everyday knowledge (Zerbst, 2024).

Moreover, the financial challenges faced by South Africans are often compounded by systemic issues such as high levels of unemployment, economic inequality, and a lack of access to quality financial education. Many individuals find themselves trapped in a cycle of debt and financial instability, unable to break free due to a lack of foundational knowledge and practical skills. The discrepancy between the theoretical understanding of financial concepts and their practical application in daily life highlights a critical area of concern. Enhanced financial education and targeted interventions are essential to bridging this gap and fostering a more financially literate population.

In this context, the role of financial literacy extends beyond individual well-being to influence broader economic stability and growth. By equipping people with the skills and knowledge to manage their finances effectively, South Africa can work towards creating a more financially resilient society. Thus, addressing financial literacy is not just about improving individual financial management but also about driving systemic change and fostering economic empowerment on a national scale.

Financial literacy and the importance thereof

Financial literacy refers to the grasp and effective use of various financial skills, encompassing a broad spectrum from budgeting and saving to debt management and retirement planning (van Rooij, Lusardi and Alessie, 2011). It involves understanding key financial concepts such as interest rates, investment options, inflation, and risk management, as well as applying this knowledge to make informed decisions (van Rooij, Lusardi and Alessie, 2011). Financial literacy enables individuals to create and adhere to a budget, prioritize savings, manage and reduce debt, and plan for long-term goals such as retirement or major life events.

The importance of financial literacy extends far beyond basic money management. It plays a critical role in achieving overall financial health by fostering the ability to navigate complex financial situations with confidence (Tamplin,2023). By understanding how to effectively manage personal finances, individuals can achieve better financial stability, which in turn leads to reduced financial stress and anxiety (Tamplin,2023). This allows for improved quality of life, as people are better positioned to handle unexpected expenses, avoid the pitfalls of poor financial decisions, and work towards their financial goals.

On a larger scale, a financially educated population can enhance economic stability, reduce reliance on social safety nets, and promote a culture of responsible financial behaviour. Thus, financial literacy is not only vital for personal financial health but also for fostering a robust and resilient economy.

Financial literacy in South Africa

According to a survey conducted by the Financial Sector Conduct Authority (FSCA) in collaboration with the Human Sciences Research Council (HSRC), approximately 51% of individuals in South Africa are financially literate (SAnews,2023). Additionally, the survey revealed that 26% of people have savings set aside for emergencies, but these savings would only last for three months (SAnews, 2023). A recent baseline survey on financial literacy in South Africa, reported that only 46% of adults tend to live for today rather than worry about providing for their future while 44% stated that they have not been actively saving and a third of South Africans have no retirement plan (SAnews, 2023). These results indicate a general lack of adequate long-term financial planning among South Africans, in turn financial literacy may become a central policy concern.

Research by development economists showed a decline in financial literacy across all educational levels and demographic groups (Nkgadima,2024). This suggests that even individuals with advanced education are not spared from the decline in financial literacy, which is imperative for economic self-sufficiency and making informed choices. Their findings are supported by the Human Sciences Research Council (HSRC), which has observed a significant drop in the national average financial literacy score, particularly impacting women, young people, and those with lower levels of education (Nkgadima, 2024). This is further supported by a research study that showed that different variables such as: age, gender, level of education, number of financial dependents, ethnicity and homeownership have a significant relationship with an individual’s level of financial literacy (du Preez & Ferreira-Schenk, 2024). With regards to age, it is positively related an individual’s level of financial literacy which means that both objective and subjective understanding of financial concepts generally improve as people get older (Henager & Cube, 2016). According to Hasler and co-author, women tend to possess lower levels of financial literacy and have less confidence in making financial decisions than men (Hasler & Lusardi, 2017). Married individuals in general have higher levels of financial literacy as couples share and aggregate their financial knowledge (Oli, 2020). In a study conducted by the HSRC, it was revealed that different ethnic groups reported carrying levels of enjoyment when taking part in financial literacy. White and Indians participants reported that they enjoyed participating with financial matters as compared to Black and Coloured respondents (HSRC, 2020).

Drivers contributing to low financial literacy

Several factors that contribute to financial low literacy include and not limited to:

- Lack of education: Insufficient or outdated financial education in schools and communities often leaves individuals without the foundational knowledge needed for effective money management.

- Limited access to resources: Inadequate access to financial resources, such as financial advisors or educational materials.

- Economic disparities: Individuals from lower socioeconomic backgrounds may face barriers such as less exposure to financial planning resources or opportunities.

- Cultural and social factors: The cultural influence and attitudes towards money, financial management and debt can impact financial literacy.

Nidar and Bestari revealed that financial literacy was affected by both external and internal factors. External factors refer to economic environment conditions, such as inflation and interest rates. Meanwhile, internal factors refer to demographic elements, such as age, gender, race, education, and socioeconomic factors (occupation and income) (Nidar & Bestari, 2012).

Interventions

The most common consumer financial education interventions in South Africa are typically those that have broad reach and significant engagement. Based on the list provided, the following interventions are among the most implemented:

- National Credit Regulator (NCR) Initiatives:

As a key regulatory body, the NCR’s initiatives are widely recognized and utilized to improve financial literacy related to credit and debt management.

- Financial Sector Conduct Authority (FSCA):

The FSCA’s campaigns and resources are extensively used to educate the public about financial products and services, leveraging its regulatory position and outreach capabilities.

- South African Savings Institute (SASI):

SASI’s focus on promoting a savings culture through various campaigns and workshops is a common and impactful approach to fostering financial literacy.

- Banking Association South Africa (BASA):

BASA’s programs, developed in collaboration with member banks, are widespread and frequently used to educate consumers on responsible banking practices.

- Educational Partnerships:

Collaborations between educational institutions and financial organizations are increasingly common, integrating financial literacy into curricula and offering specialized courses and workshops.

- Digital Platforms and Mobile Apps:

The use of digital platforms and mobile apps for financial education is growing rapidly due to their accessibility and the convenience they offer for interactive learning.

These interventions are prevalent due to their ability to reach large audiences, their integration into existing frameworks (e.g., regulatory bodies and educational systems), and their adaptability to modern digital environments.

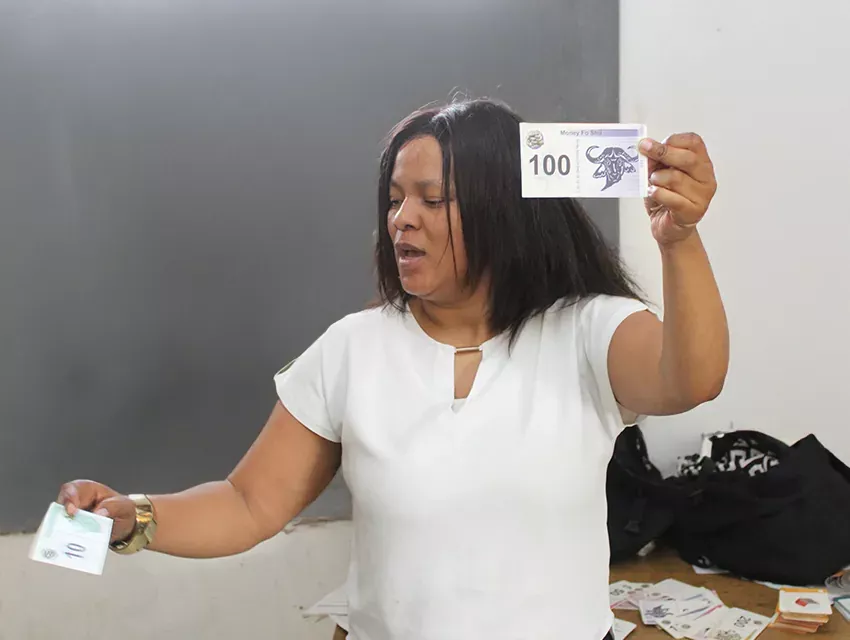

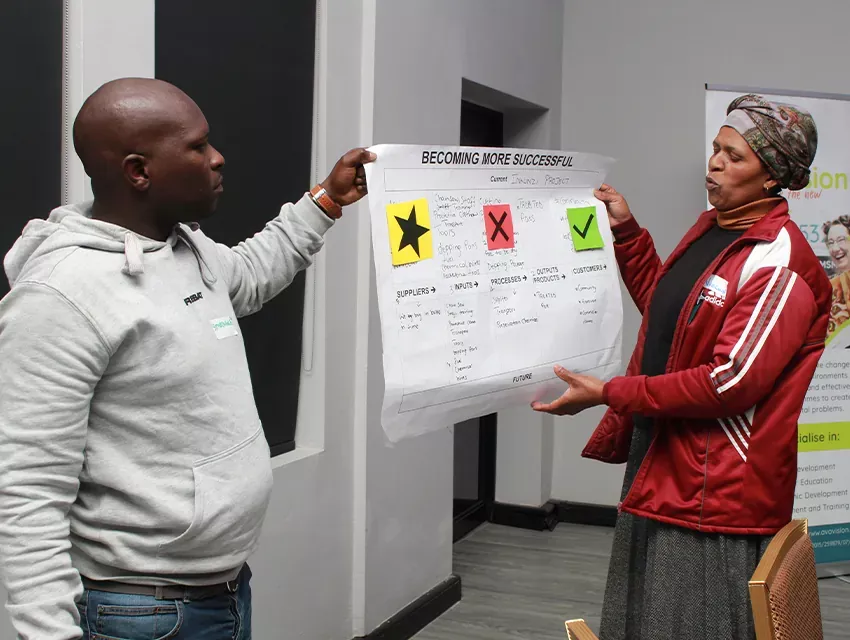

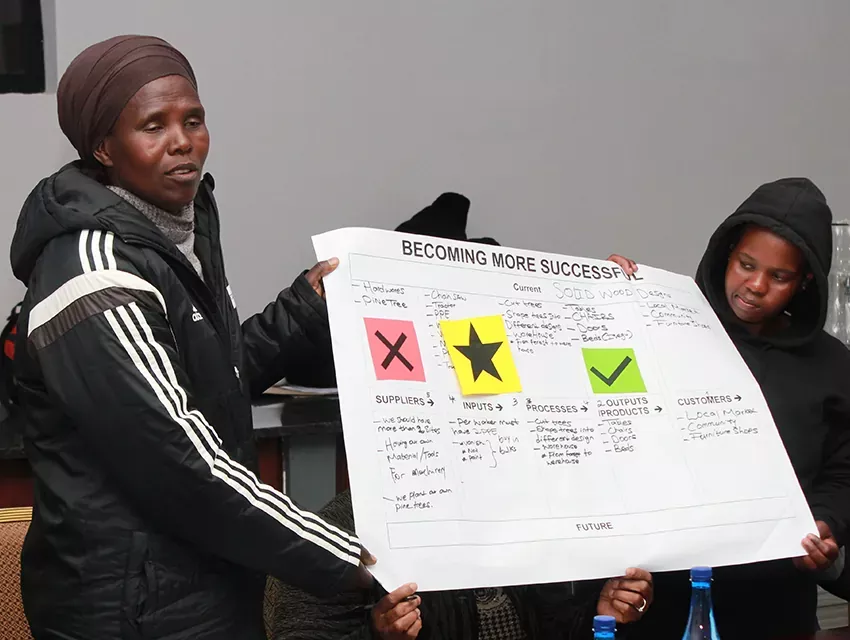

Financial Literacy Programmes Offered within Avo Vision

Avo administers a range of consumer financial education programs designed to impart essential financial skills, including saving and budgeting. To date, Avo has established partnerships with 54 clients. As of now, a total of 541,138 individuals have been trained, with an additional 2,329 participants scheduled for future training. The following section provides a detailed breakdown of the number of trained participants associated with each client. The table below highlights the top 5 clients based on the number of trained participants, though it is important to note that these are not the only partners. There are additional clients contributing to the total number of trained individuals.

|

Client |

Number of trained participants |

|

Coronation |

137 790 |

|

ABSA |

91 432 |

|

Sanlam |

82 863 |

|

Liberty |

66 750 |

|

Hollard |

56 167 |

Figure 1: Total participants trained per year

Figure 2: Total participants trained per year

Avo's financial education programs have made a significant impact on addressing the low financial literacy rates in South Africa. To date, the initiative has trained 298,718 females and 203,312 males, reflecting a broad reach across genders. Additionally, the program has specifically targeted youth, with 305,963 young individuals having received training. This focus on the younger demographic is crucial for fostering long-term financial competence.

Moreover, the programs have successfully reached 239,958 participants from rural areas, addressing the geographic disparities in access to financial education. The program's emphasis on inclusivity is further demonstrated by the fact that 465,269 black participants have been trained, highlighting efforts to bridge racial gaps in financial literacy. Collectively, these efforts contribute to a more financially informed population, which is essential for improving economic stability and opportunities in South Africa.

Key stakeholders

|

Stakeholder |

Role and Contribution |

|

Government Agencies |

Departments of Education, Finance, and Social Development can create policies and frameworks to integrate financial literacy into the national curriculum and support public awareness campaigns. |

|

Educational Institutions |

Incorporate financial literacy into curricula, provide students with essential financial skills from an early age. |

|

Businesses and Employers |

Support financial literacy through workplace programs, offer financial wellness benefits, and form partnerships with educational initiatives. |

|

Researchers |

Provide insights and data on financial literacy needs, evaluate the effectiveness of educational approaches, guide policy and program development. |

Reference List

du Preez, M., & Ferreira-Schenk, S. J. (2024). Demographic and Sociocultural Determinants of Financial Literacy in South Africa. International Journal of Economics and Financial Issues, 14(2), 111-119.

Hasler, A., & Lusardi, A. (2017). The gender gap in financial literacy: A global perspective. Global Financial Literacy Excellence Center, The George Washington University School of Business, 2-16.

Henager, R., & Cude, B. J. (2016). Financial Literacy and Long-and Short-Term Financial Behavior in Different Age Groups. Journal of Financial Counseling and Planning, 27(1), 3-19.

HSRC (Human Sciences Research Council). (2020), Financial Literacy in South Africa: Results from the 2020 Baseline Survey. Available from: https://repository.hsrc.ac.za/handle/20.500.11910/19334

Nkgadima, M. (2024, May 6). South Africans are losing financial literacy. Retrieved from BBrief: https://www.bbrief.co.za/2024/05/06/south-africans-are-losing-financial-literacy/

Oli, S. K. (2018). The influence of financial literacy on a personal financial planning: A case of Nepal. Afro-Asian Journal of Economics and Finance, 1(1), 25-38.

SA urged to make smart financial decisions. (2023, August 4). Retrieved from SAnews: https://www.sanews.gov.za/south-africa/sa-urged-make-smart-financial-decisions

Tamplin, T. (2023, October 6). Why Financial Literacy Is Important and How You Can Improve Yours. Retrieved from Forbes: https://www.forbes.com/sites/truetamplin/2023/09/21/financial-literacy--meaning-components-benefits--strategies/

van Rooij, M., Lusardi, A. and Alessie, R., 2011. Financial literacy and stock market participation. Journal of Financial Economics, 101(2), pp.449-472.

Zerbst, F. (2024, May 9). 5 Online programmes to enhance your financial literacy. Retrieved from Just Money: https://www.justmoney.co.za/articles/5-online-courses-to-enhance-your-financial-literacy/